Building Information Ireland gives you all the sales and marketing tools you need to find and manage Construction Project Leads – Take your free trial today

2,387 New Houses Started Construction in Dublin and Commuter belt in last three months.

Latest numbers on www.buildinginfo.com show 79 projects kicked off since June 2019 with a combined total of 2,387 Houses. Houses that is not Apartments.

Register for your FREE TRIAL today and get details of all these projects

Our database contains details on literally hundreds of new Hotel Construction projects. Our research team track these projects from pre-planning phase right through to site commencement. We provide our subscribers with key data on the size and scale of each development, including contact details for design teams, engineers and contractors as well as an estimated construction value. Many of Ireland’s leading suppliers to the Hotel and Hospitality sector rely on BuildingInfo.com to keep their sales and supply pipelines topped up.

Register for our free trial today for more details on all Hotel Construction projects in Ireland.

Below: Top 10 Hotel Construction projects commenced during 2018

| ID | Description | Floor (Sq M) | Start Date |

| 75467 | €61m Hotel Development in Moss St. Dublin 6 | 21526 Sq M | 28/12/18 |

| 102166 | €46m Hotel Development in Clonshaugh Rd. Dublin 4 | 16059 Sq M | 10/08/18 |

| 91841 | €35m Hotel Development in North Wall Dublin 3 | 12302 Sq M | 25/06/18 |

| 41937 | €33m Hotel Extension in Naas Co. Kildare | 11520 Sq M | 18/06/18 |

| 90183 | €33m Hotel Development in Middle Abbey St. Dublin 3 | 11780 Sq M | 13/12/18 |

| 62570 | €30m Hotel Development in Thomas St. Dublin 8 | 10610 Sq M | 25/12/18 |

| 73707 | €25m Hotel Construction in Chancery St. Dublin 7 | 8857 Sq M | 09/08/18 |

| 85606 | €22m Hotel Development in Ormond Quay Dublin 2 | 7781 Sq M | 18/07/18 |

| 44030 | €18.2m Hotel Development in Shaw St. Dublin 2 | 6405.7 Sq M | 05/10/18 |

| 66843 | €18m Hotel Development in Bohermore Galway | 6310 Sq M | 13/12/18 |

The table below provides a sample of Medical Construction projects commenced in the last 3 months. Each of these Medical Construction projects has a construction value of greater than €1 million. At Building Information Ireland we provide our subscribers with full details on all Medical Construction projects taking place throughout Ireland and Northern Ireland.

| Project ID | Title | Location | Start Date |

| 31 | €21.9m Nursing Home Project in Co. Dublin | Old Ballymun Rd | 08/10/18 |

| 94766 | €11.3m Care Home Development in Co. Dublin | Cabra | 03/09/18 |

| 62734 | €11m Care Home Development in Co. Dublin | Monastery Park | 30/10/18 |

| 52756 | €6.2m Medical Centre in Co. Cork | Inchydoney Rd | 28/08/18 |

| 91737 | €4.3m Care Home Extension in Co. Cork | Belgooly | 27/08/18 |

| 49241 | €2m Nursing Home Extension in Co. Wicklow | Arklow | 31/10/18 |

| 98395 | €1.3m Dental Surgery Alterations in Co. Limerick | Castletroy | 04/10/18 |

| 85337 | €1.1m Care Centre Alterations in Co. Dublin | Kilternan | 15/08/18 |

| 92858 | €1.16m Respite Care Centre Alterations in Co. Clare | Scarriff | 05/10/18 |

To access details on all of the projects listed above please register for your FREE TRIAL here.

Construction & planning activity by sector during September 2018. The table below outlines the volumes of projects either submitted for planning, granted planning permission or commenced construction.

| Applied | Granted | Commenced | |

| Agriculture Construction | 124 | 128 | 31 |

| Commercial Construction | 139 | 133 | 45 |

| Education Construction | 55 | 35 | 39 |

| Industrial Construction | 84 | 56 | 24 |

| Medical Construction | 25 | 20 | 8 |

| Residential Construction | 288 | 151 | 48 |

| Social Construction | 98 | 77 | 19 |

Register for our FREE TRIAL to access details on projects listed.

| ID | Title | Start Date |

| 102012 | €76.5m Housing Development in Co. Meath | 24/09/2018 |

| 133214 | £50m Office Extension in Belfast | 01/09/2018 |

| 56228 | €47m Residential Development in Co. Kildare | 17/09/2018 |

| 112360 | €42m Cairn Homes Residential Development in Co. Dublin | 26/09/2018 |

| 86840 | €29m Office Development in Co.Cork | 24/09/2018 |

| 99991 | €19.8m Gannon Homes Housing Development in Co. Dublin | 13/09/2018 |

| 74229 | €19m Warehouse Construction in Co. Dublin | 17/09/2018 |

| 88381 | €19m Houses Development in Co. Galway | 14/09/2018 |

| 87149 | €17m Aston Housing Development in Co. Laois | 07/09/2018 |

| 59723 | €16m Green REIT Development in Co. Dublin | 21/09/2018 |

At Building Information Ireland we research and publish data on all Construction Projects throughout Ireland. We cover all sectors and provide our subscribers with accurate information on the size and scale of all construction projects as well as the key contact details of the companies involved.

The image below shows that almost 300 Industrial Construction Projects have been submitted for planning permission since January 1st 2018. The largest of these schemes is the €53 million Data Storage Facility in Arklow Co. Wicklow (ID 129930)

Industrial Construction Projects submitted for planning in 2018

Through our dedicated research team at Building Information Ireland we research and publish details on all Industrial Construction Projects submitted for planning in all 32 counties.

The image below details 186 Hotel and Guesthouse Construction projects submitted for planning during 2018 year-to-date. The largest of these schemes, by build value estimate, is the 177 room Killeen Castle Development in Co. Meath which was submitted for planning in May and was subsequently granted planning permission at the end of June.

Building Information Ireland research and publish key information on all Hotel construction projects throughout Ireland. Our clients use this valuable sales generating data to strategically direct their sales and marketing teams and to keep up-to-date with the latest developments in this sector. We offer a free trial and demonstration of this online business tool.

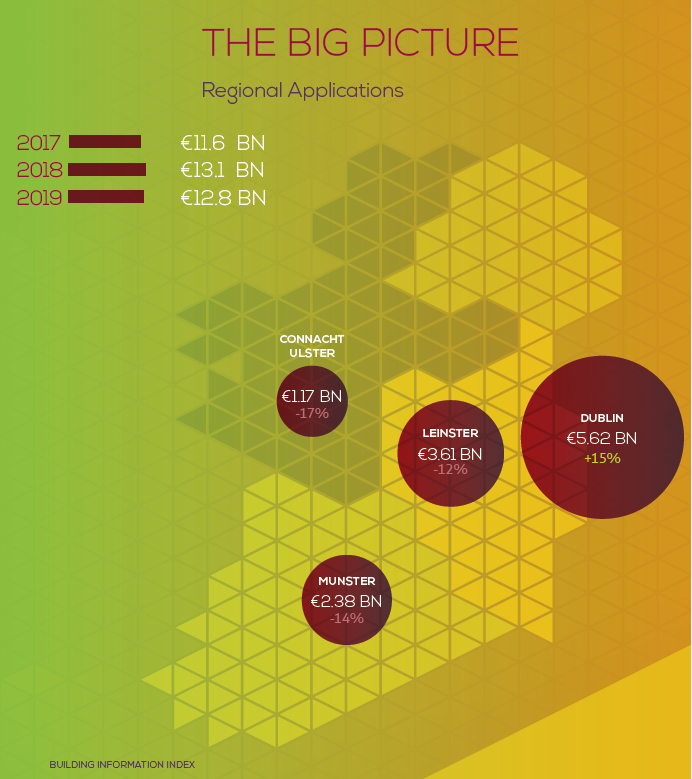

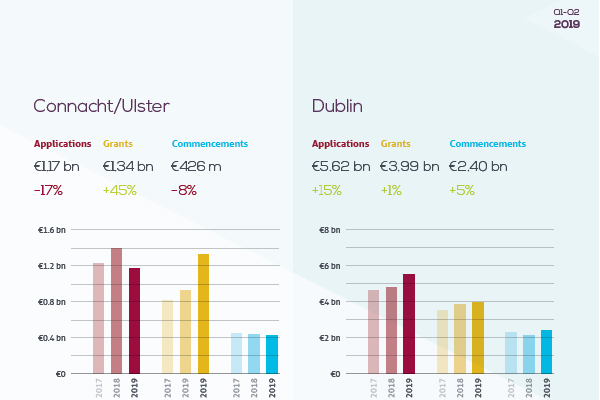

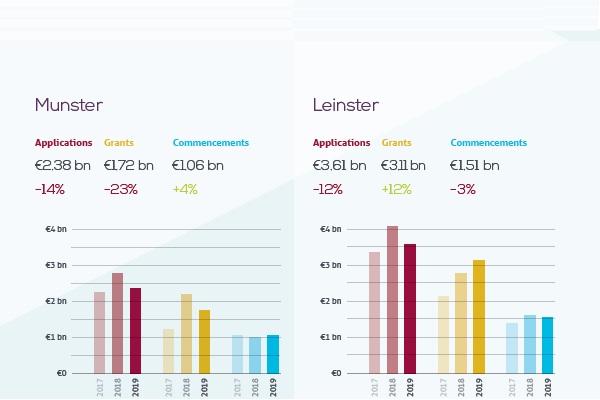

In this year-end volume of the Building Information Index the levels of activity in the construction industry are compared and analysed across the 3 full year periods of 2015, 2016 & 2017. The activity is broken down into key sectors and regions, and also across important stages of the construction and planning life cycle.

The key message displayed in the findings of this Index is that output has increased steadily year on year over the 3 year period and will continue to grow in the short to medium term. While the growth rate may be slowing marginally, we forecast growth in the region of 9% for 2018 with the likelihood of positive growth continuing into 2019.

Value of construction project Commencements grows by +31% in 2017

The value of Construction Project Commencements grows by +31% in 2017 when compared with 2016. The value is up +67% when compared with 2015. Construction projects with a combined value of €10.7bn Building Information Ireland commenced in the year. Growth was recorded in 6 of the 7 sectors analysed with only Industrial project commencement activity showing a year on year decline.

Dublin continues to dominate the industry where over 51% of the entire country commencements took place in 2017. This trend is growing with the same calculation last year showing Dublin at 45%. Residential developments accounts for 54% of Project Commencements in 2017 which is consistent with 2016 and shows the importance it is to the industry as a whole.

Value of Applications up +11%

The value of construction project Applications is up +11% in 2017 and +16% for the 2 year period to 2015. Overall, the pipeline of project Applications was €23.2bn for 2017, up from €20.8bn in 2016. Again Dublin accounts for the largest share, but the percentage is falling, and now stands at just under 39% of the overall, compared with 44% last year.

Residential projects also make up the lion’s share of project Applications with €14.9bn worth of applications, just over +64% of all applications by volume. Commercial & Retail, the second largest sector recorded a decrease in Applications, -13%, as did 4 other sectors in 2017. This points to a potential cooling off in construction output in the medium term with growth rates remaining in single digits at best through 2019 and 2020.

Interview with Michelle Barrett

How do Proline hardware specialise for the Irish construction sector?

Proline Architectural Hardware has been in business for 14 years and have grown to become one of

the leading companies for the supply of ironmongery into various construction projects.

We have a brand new showroom and display area for clients to visit and select from and we offer a

full scheduling service for all projects.

We are main agents for the following Brands within the Ironmongery Market:

• Arrone Commercial and Domestic Ironmongery – www.Hoppe.com

• JNF – Modern Designer Ironmongery – www.JNF.pt

• Heritage Brass and Sorrento- www.m-marcus.com

• From the Anvil – www.fromtheanvil.co.uk

• Argenta Invisidor Frames – www.argentalu.com

• Ermetika Pocket Door Sliding Systems – www.ermetika.it

What other services do Proline provide?

We also provide a design solution for architects, interior designers and specifiers on

their ironmongery requirements which include:

• Ironmongery Scheduling Service

• Invisible Door Solutions

• Access Control Solutions

• Door & Window Hardware

• Glass Door Solutions

• Mailbox Systems

• Intumescent & Fire Stopping Solutions

• Joinery, Airtightness Products plus many more

What recent projects have you been involved in?

Some examples of finished contract projects are:

| Project | Contractor |

| St Aidan’s Social Housing Project in Tallaght | John Sisk & Sons |

| Royal College of Surgeon’s Stephen’s | Green Bennett Construction |

| Honey Park / Cualanor / Leona / Charlotte | Cosgrave Developments |

| Cleye Farm | Park Developments |

| Google Commercial Buildings – various | Structuretone |

| Diswellstown Housing and Apartments | Park Developments |

| Frascatti Centre | Collen Construction |

| Knocknacarra School | Stewart Construction |

You have been subscribed to BuildingInfo for some time now – has it been

beneficial to date?

Definitely 100% – The www.buildinginfo.com website is extremely important to us, as it helps to

identify projects of interest in an easy and timely manner. It also boasts a fantastic user friendly

platform and the email alerts keep us to date on important project commencements.

www.prolinehardware.com | +353 1 453 6633